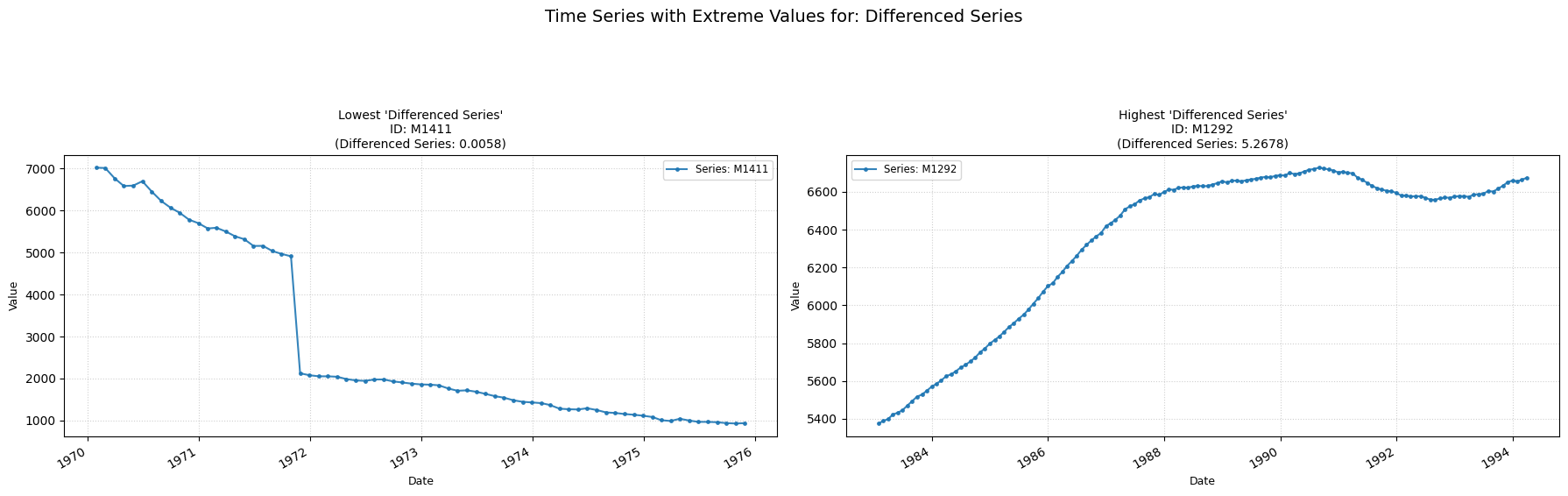

Differenced Series

diff_series

Computes the autocorrelation value of the differenced series.

Low value: Means there is no linear relationship between past and current values in the de-trended series.

High value: Means there is a significant linear relationship between past and current values in the de-trended series.

No Parameters

Calculation

-

First Differencing: A new time series is created by taking the first differences of the original series, DYt = Yt+1 − Yt for t=1,...,N−1.

-

Autocorrelation of Differenced Series: Then the first 10 autocorrelation coefficients (ρ1,ρ2,...,ρ10) of the differenced series are calculated, using the same method as the ac feature.

-

Sum of Squares: The returned value is calculated as the sum of the squares of these first 10 autocorrelation coefficients.

Practical Usefulness Examples

Financial Returns Analysis: Stock prices are often non-stationary (have a trend/random walk). Analyzing the autocorrelation of their differences (returns) helps identify if there's any remaining predictability after removing the primary random walk component.

Process Improvement: If a process output shows a trend, differencing can make it stationary. This feature can then reveal if there are lingering systematic patterns in the rate of change that could be addressed.